Memory chip manufacturer Micron (NASDAQ: MU) threw investors for a loop on Thursday with a quarterly report that featured an outlook that wasn’t even in the ballpark of Wall Street’s expectations.

In the first quarter of its fiscal 2025, Micron’s performance was solid, buoyed by soaring demand for high-bandwidth memory (HBM), which is critical for AI accelerators. However, the companies that buy its PC and mobile memory chips now have too much inventory on hand and are pulling back. Micron’s guidance for the fiscal second quarter calls for revenue of $7.9 billion, more than $1 billion below the consensus analyst estimate.

Micron is pitching itself as an AI play. The company predicts that the market for HBM chips will soar from $16 billion this year to more than $100 billion in 2030. Investors, though, were more concerned about the company’s weak near-term outlook than they were excited about the AI opportunity on Thursday, sending the stock down by a double-digit percentage in the session. While demand for high-bandwidth memory will almost certainly continue to rise, it’s unlikely to escape the boom-and-bust nature of the memory chip market.

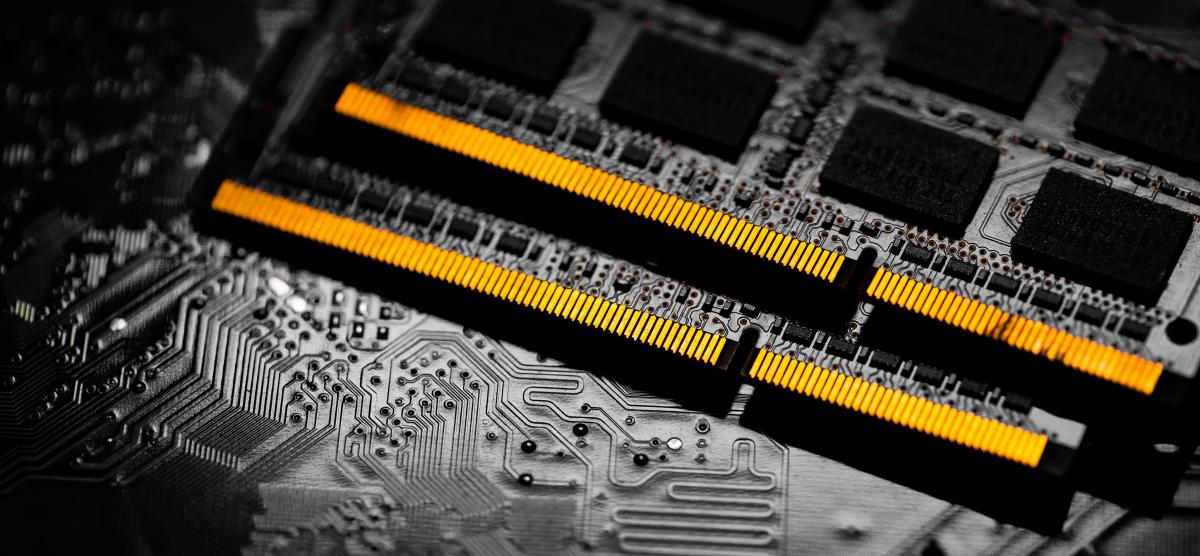

A large proportion of the DRAM and NAND chips that Micron and its competitors sell are commodity products, and as such, their pricing is tied tightly to supply and demand. During times when demand outstrips supply, manufacturers can boost prices and profits can soar. Building out new chip manufacturing capacity is a capital-intensive process, and it takes time, so shortage situations can persist for a while.

Inevitably, though, competing memory chip manufacturers build out too much total capacity in reaction to expected future demand. Once supply starts to outstrip demand, prices can tumble and profits can turn into steep losses. While chipmakers can respond to that situation by cutting production, all it takes to keep an oversupply situation dragging on is one player prioritizing market share. Often, those down cycles come to an end when the most aggressive manufacturer starts burning cash and is forced to slash production.

The market’s demand for high-bandwidth memory is insatiable at the moment, so pricing is strong. HBM sales are currently boosting Micron’s profit margins, offsetting the impact of its lower-margin products. Predictions are in the stratosphere. Some estimates forecast the AI chip market will grow by a factor of 10 between 2023 and 2032, exceeding the current size of the entire semiconductor market.